- Do thorough research on local market conditions, zoning laws, building codes, and land use regulations before starting a real estate development project.

- Create an effective business plan with objectives, budget, timeline, and risk management strategies outlined.

- Invest in quality tools and safety equipment to ensure successful projects.

- Find the right location that is in demand, easily accessible, and suitable for the project.

- Secure financing through traditional bank loans, private equity, crowdfunding, or seller financing.

Real estate development is an exciting and lucrative field where investors can create opportunities to build, renovate, and sell properties for a healthy profit. With the right knowledge and resources, anyone can start real estate development. However, it is crucial to understand the steps involved and what it takes to be successful in this industry.

Here are the basics of real estate development and provide some practical tips on how to get started. Whether you are a beginner or just looking to learn more about this industry, is guide will be helpful for you.

Do Your Research

Before starting any real estate development project, it is essential to do your research. This includes researching the local market conditions, zoning laws, building codes, land use regulations, and any other relevant factors affecting your plans. Understanding the local market and the needs of potential buyers or renters is critical for the success of any project.

Moreover, it is essential to be familiar with local property values and trends to assess the potential profitability of a development project. An accurate understanding of the costs of a specific development, including materials, labor, permits, and other fees, will help you make informed decisions.

Create a Sound Business Plan

Having a sound business plan is essential for any real estate development project. Your goal should include your objectives, budget, and timeline, and consider factors like market analysis, site selection, financing options, and risk management strategies.

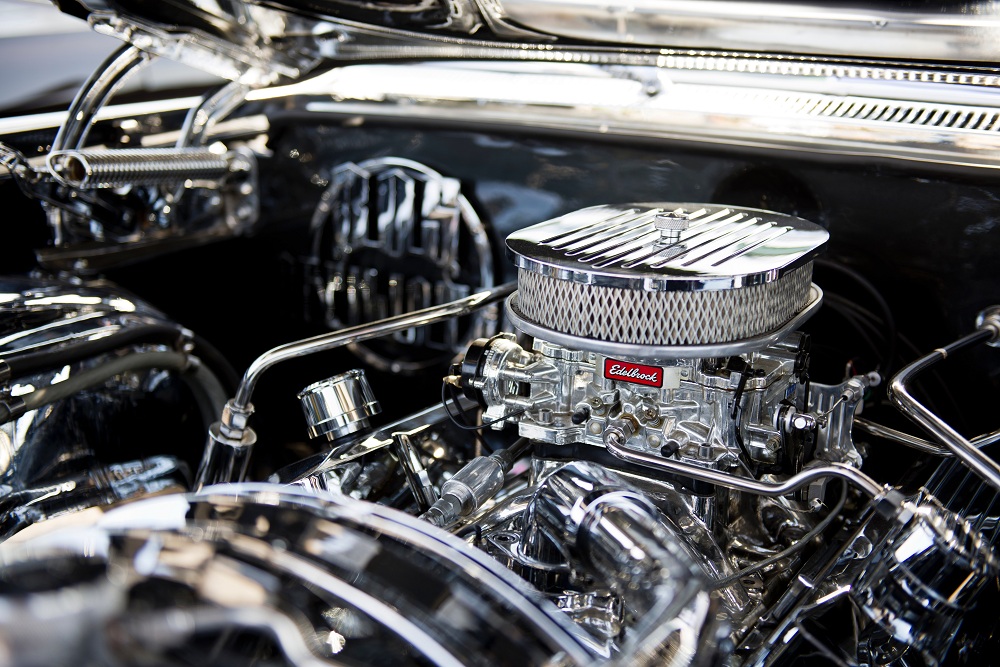

Invest in the Right Equipment

The success of your real estate development project will largely depend on the equipment you use. Investing in high-quality tools and materials is essential to any successful development project. Also, investing in necessary safety gear can help you protect yourself and your workers from potential hazards.

It is essential to have the right machinery and tools fit for properties just about to start development. All-terrain cranes are often used in this type of situation to move heavy material and equipment around a work site. Investing in an all-terrain crane can be crucial for successful real estate development projects.

Find the Right Location

Location is one of the most important factors when planning a real estate development project. You must identify a site that is in demand, easily accessible, and suitable for your project type. The right place can mean the difference between a successful project and a failure.

Secure Financing

One of the biggest challenges real estate developers face is securing financing for their projects. With many financing options available in the market, it can be overwhelming for developers to choose the right one. Here are four practical ways to secure financing for real estate development projects.

Traditional Bank Loans

Traditional bank loans are a viable choice for developers looking for a safe and secure financing option. Bank loans are usually based on the developer’s creditworthiness, previous projects, and other financial documents.

One downside of bank loans is the lengthy and arduous application process, which can take several weeks or months to complete. However, with low-interest rates and flexible repayment terms, bank loans are a popular choice for developers.

Private Equity

Private equity is an excellent method to secure financing for real estate development. It’s an attractive option for developers who don’t have the financial resources to finance their projects fully.

With private equity, developers can gain access to funds quickly, and the approval process is relatively easy and fast. Private equity firms often specialize in real estate development and look for high-risk, high-potential projects. However, private equity has higher interest rates and more significant risks than traditional bank loans.

Crowdfunding

Crowdfunding is another excellent way to secure financing for real estate development projects. Crowdfunding allows small investors to invest in real estate projects in exchange for equity or debt. Developers can post their projects on crowdfunding platforms like RealtyMogul or Fundrise and access capital from numerous investors willing to invest in their projects.

Crowdfunding provides developers access to a more significant pool of potential investors, and the approval process is usually fast, but it comes with high costs.

Seller Financing

Seller financing is another effective way to secure financing for real estate development. It involves the developer buying from the seller over time and making payments directly to the seller, much like a mortgage.

This option enables developers to avoid a traditional lender, saving them the hassle of a long and complex application process. Seller financing is cost-effective but not as common as other options like bank loans or private equity.

Final Thoughts

Real estate development can be a lucrative and exciting career path for those with the proper knowledge and resources. Remember that real estate development is a complex process, and it takes time, effort, and dedication to be successful. However, anyone can get started in this exciting field with the right approach and a willingness to learn.