Car ownership in the U.S. may cost around $700 per month or almost $8,500 for a car driven 15,000 miles every year based on an AAA estimate. The actual price will vary depending on the type of vehicle.

If you recently bought a Subaru, car maintenance expenses should be covered under a basic three-year warranty or a 36,000-mile coverage. Every purchase should also have a five-year powertrain warranty or a 60,000-mile coverage. Take note that the warranties are only extended for 2000 and later models. Those who want a low-maintenance vehicle should consider buying certain models from Ford, Honda, or Kia.

Calculating Cost of Ownership

Several factors affect the overall cost of vehicle ownership, whether it’s new or old. However, used cars may consume more fuel and require more repairs. On the other hand, buying a new car involves a higher upfront payment. AAA’s estimate excluded the cost of monthly payments when you take out a loan for a purchase.

In the first quarter of 2018, the average installment cost more than $500 per month. While monthly installments, taxes, and insurance are fixed costs, owners of the same vehicle model won’t spend the same amount on fuel. You could calculate your gas expenses on the FuelEconomy.gov website by dividing the number of driven miles per month with the car’s fuel economy rating, and then multiply the number by the cost per gallon of fuel in your city or state.

The Rate of Depreciation

Some people don’t just buy second-hand cars to save money, but also avoid spending a lot on a car that greatly depreciates in value. It could lose up to 30% of its resale value after the first 12 months, even when you take good care of your car. You should expect the value to fall continually in the next five years, ranging between 15% and 18%.

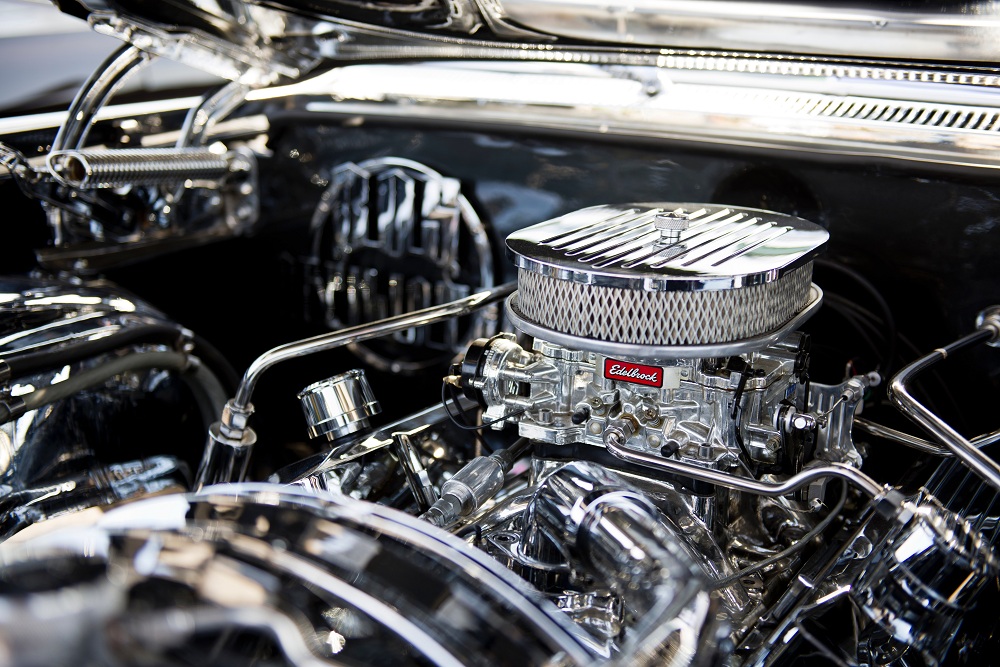

But, there are still certain advantages to buying a new car. For instance, a used vehicle will require you to take a closer look at its parts and functionality. There’s also the risk of spending more on repairs, or problems that could arise months after you bought it. A new car eliminates all of these potential issues.

How to Reduce Expenses

An ideal budget for vehicle expenses should only comprise less than 20% of your net income every month. Look for a lower insurance premium if you unknowingly spend more than necessary. Those who plan on buying a new car should also consider an extended warranty.

Bring your car for routine maintenance to keep your car in good shape. Remember that older cars need more frequent inspections, while new ones should be taken to a car shop when it reaches three years old.

More people have decided to buy a used vehicle to save money, especially since the value of cars depreciate significantly over time. Whether you decide to buy a new or used car, it’s important to look for a reputable auto mechanic for maintenance and repairs. How much are you willing to spend on vehicle ownership?